| Description | APY* | Rate |

|---|---|---|

| 3 months | 0.20% | 0.20% |

| 6 months | 0.25% | 0.25% |

| 9 months | 0.35% | 0.35% |

| 12 months | 0.45% | 0.45% |

| 18 months | 0.50% | 0.50% |

| 24 months | 0.60% | 0.60% |

| 36 months | 0.70% | 0.70% |

| 48 months | 0.75% | 0.75% |

| 60 months | 0.85% | 0.85% |

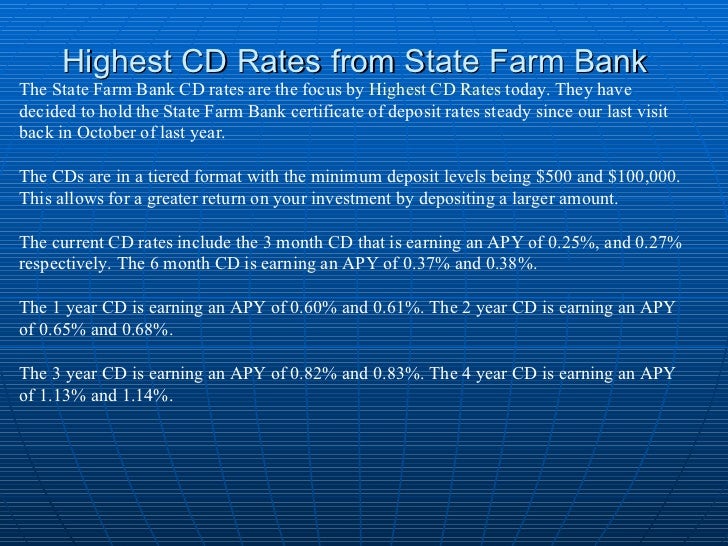

2 year CD rates at State Farm Bank were increased from 2.32 percent with an APY of 2.35 percent to 2.47 percent with an APY of 2.50 percent. These CD rate increases at State Farm Bank are on regular CDs jumbo CDs, IRA CDs, and jumbo IRA CDs. As with any CD account, there are early withdrawal penalties. State Farm Bank was established in 1998. It is part of the insurance and financial services group State Farm, which is a mutual company. The parent company was established in 1922.

*APY denotes Annual Percentage Yield

Rates and information are subject to change at any time. Recurring deposits may be made into the certificate through automatic transfers (ATS) only. You may set up recurring deposits through ATS within 30 days after the certificate is purchased. Deposits can be stopped or reduced at any time. This rate will be paid until the certificate matures. Your certificate will automatically renew at the rate in effect at the time of maturity unless we are contacted on or before the maturity date. Upon renewal, the term will be the same as the original term. You have ten calendar days after maturity to redeem your certificate without penalty if you do not want to renew. If the member has not contacted PSECU by the maturity date, the certificate will renew for the rate in effect on the date of maturity and for the same term as the original term. A penalty will be imposed for early withdrawal. A minimum daily balance of $500 must be maintained in order to earn the disclosed APY.

State Farm Bank Money Market Rates

State Farm 5 Year Cd Rates

This content provided is for informational purposes only. Nothing stated is to be construed as financial or legal advice. PSECU recommends that you seek the advice of a qualified financial, tax, legal or other professional if you have questions.